When dealing with financial calculations, errors can lead to significant discrepancies in outcomes. One common issue encountered is the "Principal Error," which occurs when the principal amount is incorrectly stated or calculated. This error can have far-reaching consequences, affecting interest rates, repayment terms, and overall financial planning. In this article, we will delve into the concept of the Principal Error, its implications, and provide 5 ways to fix it, ensuring accuracy and reliability in financial calculations.

Key Points

- Understanding the Principal Error and its causes

- Importance of accurate principal amount in financial calculations

- Methods to identify and correct Principal Errors

- Strategies to prevent future occurrences of Principal Errors

- Best practices for maintaining accuracy in financial calculations

Understanding the Principal Error

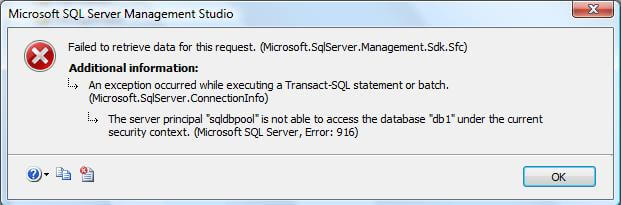

The Principal Error refers to any mistake made in the calculation or statement of the principal amount in a financial transaction or calculation. This error can arise from various sources, including incorrect data entry, miscalculations, or misunderstandings of financial terms. The Principal Error can significantly impact financial decisions, as it affects the calculation of interest, dividends, and other financial metrics. For instance, in a loan agreement, an incorrect principal amount can lead to incorrect interest calculations, potentially resulting in overpayment or underpayment of interest.

Causes of the Principal Error

The causes of the Principal Error are diverse and can be attributed to human error, system glitches, or lack of understanding of financial principles. Some common causes include:

- Incorrect data entry: Entering incorrect numbers or figures into financial calculations can lead to Principal Errors.

- Miscalculations: Errors in mathematical operations, such as addition, subtraction, multiplication, or division, can result in incorrect principal amounts.

- Misunderstandings of financial terms: Lack of understanding of financial terminology, such as principal, interest, and dividends, can lead to Principal Errors.

5 Ways to Fix the Principal Error

Fixing the Principal Error requires a systematic approach to identify and correct the mistake. Here are 5 ways to fix the Principal Error:

1. Verify Data Entry

The first step in fixing the Principal Error is to verify the data entry. This involves re-checking the numbers and figures entered into financial calculations to ensure accuracy. Double-checking data entry can help identify and correct errors, preventing further complications.

2. Recalculate Financial Metrics

Once the Principal Error is identified, it is essential to recalculate financial metrics, such as interest, dividends, and repayment terms. This step ensures that all financial calculations are accurate and reliable, reflecting the correct principal amount.

3. Review Financial Documents

Reviewing financial documents, such as loan agreements, contracts, and financial statements, can help identify Principal Errors. This step involves scrutinizing financial records to ensure that all principal amounts are accurate and consistent.

4. Consult Financial Experts

In some cases, Principal Errors may require the expertise of financial professionals. Consulting financial experts, such as accountants or financial advisors, can provide valuable insights and guidance on correcting Principal Errors and preventing future occurrences.

5. Implement Quality Control Measures

Finally, implementing quality control measures can help prevent Principal Errors. This involves establishing protocols for data entry, calculation, and review of financial metrics to ensure accuracy and reliability. Quality control measures can include regular audits, checks, and balances to detect and correct errors before they become significant issues.

| Financial Metric | Correct Principal Amount | Incorrect Principal Amount |

|---|---|---|

| Interest Rate | 5% | 10% |

| Repayment Term | 5 years | 10 years |

| Dividend Yield | 3% | 6% |

Preventing Future Occurrences of Principal Errors

Preventing future occurrences of Principal Errors requires a proactive approach. This involves establishing protocols for data entry, calculation, and review of financial metrics to ensure accuracy and reliability. Regular audits, checks, and balances can help detect and correct errors before they become significant issues. Additionally, providing training and education on financial principles and terminology can help individuals and organizations avoid Principal Errors.

Best Practices for Maintaining Accuracy in Financial Calculations

Maintaining accuracy in financial calculations is crucial for making informed decisions and achieving financial goals. Some best practices for maintaining accuracy include:

- Verifying data entry

- Recalculating financial metrics regularly

- Reviewing financial documents regularly

- Consulting financial experts when necessary

- Implementing quality control measures

What is the Principal Error, and how does it affect financial calculations?

+The Principal Error refers to any mistake made in the calculation or statement of the principal amount in a financial transaction or calculation. This error can significantly impact financial decisions, as it affects the calculation of interest, dividends, and other financial metrics.

How can I prevent Principal Errors in my financial calculations?

+To prevent Principal Errors, it is essential to verify data entry, recalculate financial metrics regularly, review financial documents regularly, consult financial experts when necessary, and implement quality control measures.

What are the consequences of not addressing Principal Errors?

+Failing to address Principal Errors can lead to significant financial consequences, including incorrect interest calculations, overpayment or underpayment of interest, and poor financial decision-making.

In conclusion, the Principal Error is a critical issue that can have far-reaching consequences in financial calculations. By understanding the causes of the Principal Error and implementing the 5 ways to fix it, individuals and organizations can ensure accuracy and reliability in financial calculations. Additionally, preventing future occurrences of Principal Errors and maintaining accuracy in financial calculations are crucial for making informed decisions and achieving financial goals.