The concept of irrevocability is a fundamental principle in various fields, including law, finance, and personal relationships. At its core, irrevocability means that a decision, action, or agreement is permanent and cannot be undone or reversed. This principle is essential in ensuring the stability and predictability of transactions, contracts, and commitments. In this article, we will delve into the nuances of irrevocability, exploring its implications, applications, and significance in different contexts.

Key Points

- Irrevocability implies permanence and finality in decisions, actions, or agreements

- It is a critical concept in law, finance, and personal relationships

- Irrevocable decisions or actions can have significant consequences and implications

- Understanding irrevocability is essential in making informed decisions and commitments

- Irrevocability can provide stability and predictability in transactions and contracts

Irrevocability in Law

In the legal sphere, irrevocability is a crucial concept that ensures the integrity and enforceability of contracts, agreements, and court decisions. For instance, a court judgment or a contractual agreement can be considered irrevocable if it is deemed final and binding. This means that the parties involved cannot unilaterally revoke or modify the agreement without the consent of the other parties or a court order. The principle of irrevocability in law provides a framework for resolving disputes and enforcing obligations, thereby maintaining social order and stability.

Types of Irrevocable Agreements

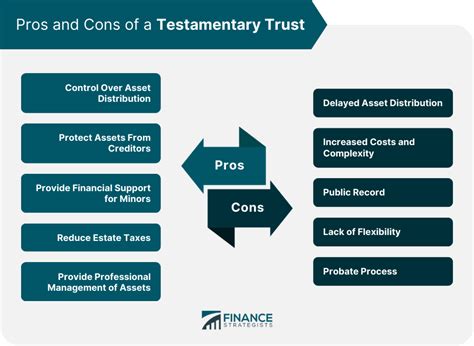

There are various types of irrevocable agreements, including irrevocable trusts, irrevocable powers of attorney, and irrevocable contracts. An irrevocable trust, for example, is a type of trust that cannot be modified or terminated once it is established. This means that the grantor (the person creating the trust) cannot revoke the trust or change its terms without the consent of the beneficiaries or a court order. Irrevocable powers of attorney, on the other hand, grant an agent the authority to make decisions on behalf of the principal, and these decisions are generally considered final and binding.

| Type of Agreement | Description |

|---|---|

| Irrevocable Trust | A trust that cannot be modified or terminated once established |

| Irrevocable Power of Attorney | A grant of authority to an agent to make decisions on behalf of the principal |

| Irrevocable Contract | A contract that is final and binding, and cannot be unilaterally revoked or modified |

Irrevocability in Finance

In finance, irrevocability is a critical concept that applies to various transactions, including investments, loans, and credit agreements. For instance, an irrevocable letter of credit is a type of letter of credit that cannot be canceled or modified once it is issued. This provides a guarantee of payment to the beneficiary, and the issuer cannot revoke the letter of credit without the consent of the beneficiary or a court order. Irrevocable financial transactions can provide a high level of security and stability, but they can also limit flexibility and create rigid obligations.

Implications of Irrevocability in Finance

The implications of irrevocability in finance are significant, and they can have far-reaching consequences. For example, an irrevocable investment decision can result in a permanent loss of capital if the investment does not perform as expected. Similarly, an irrevocable loan agreement can create a rigid obligation to repay the loan, regardless of changes in financial circumstances. It is essential to carefully consider the terms and conditions of a financial transaction before making it irrevocable.

What is the difference between an irrevocable trust and a revocable trust?

+An irrevocable trust is a type of trust that cannot be modified or terminated once it is established, whereas a revocable trust can be modified or terminated by the grantor at any time.

Can an irrevocable agreement be modified or terminated?

+An irrevocable agreement is generally considered final and binding, and it cannot be modified or terminated without the consent of all parties involved or a court order.

What are the implications of irrevocability in finance?

+The implications of irrevocability in finance are significant, and they can have far-reaching consequences. Irrevocable financial transactions can provide a high level of security and stability, but they can also limit flexibility and create rigid obligations.

In conclusion, irrevocability is a fundamental principle that implies permanence and finality in decisions, actions, or agreements. It is a critical concept in law, finance, and personal relationships, and it can have significant consequences and implications. Understanding irrevocability is essential in making informed decisions and commitments, and it can provide stability and predictability in transactions and contracts. By recognizing the importance of irrevocability, individuals and organizations can navigate complex situations with greater clarity and confidence.