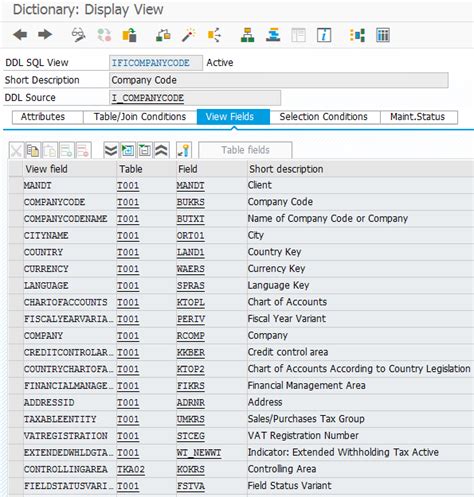

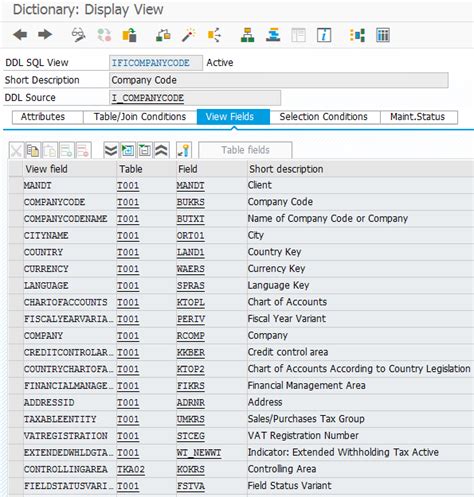

The SAP Company Code table is a crucial component of the SAP Enterprise Resource Planning (ERP) system, particularly in the Financial Accounting (FI) module. It serves as a central repository for storing and managing company code-related data, which is essential for financial reporting, accounting, and compliance purposes. In this article, we will delve into the details of the SAP Company Code table, its structure, and its significance in the SAP ecosystem.

Introduction to SAP Company Code Table

The SAP Company Code table, also known as T077S, is a standard SAP table that contains information about company codes, which are unique identifiers for each company or subsidiary within a corporate group. Each company code represents a separate legal entity, with its own financial statements, accounting records, and tax obligations. The Company Code table is used to store and manage data related to company codes, such as company code descriptions, addresses, and financial reporting requirements.

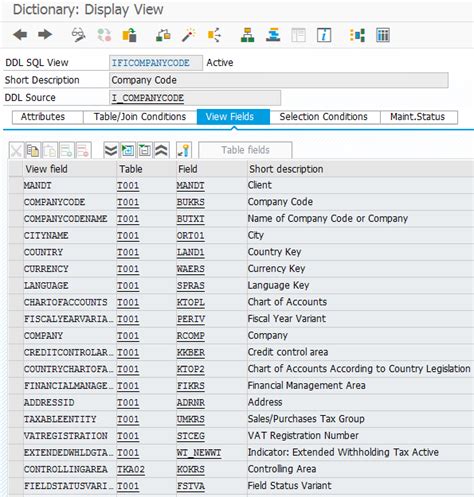

Structure of the SAP Company Code Table

The SAP Company Code table consists of several fields, including:

- Company Code (BUKRS): a unique identifier for each company code

- Company Code Description (BUKRS_TEXT): a descriptive text for each company code

- Address (STRAS, STRAS2, STRAS3, STRAS4): the address of the company code

- City (ORT01): the city where the company code is located

- Postal Code (PSTLZ): the postal code of the company code

- Country (LAND1): the country where the company code is located

- Currency (WAERS): the currency used by the company code

- Financial Reporting Requirements (FINREP_REQ): flags indicating whether financial reporting is required for the company code

| Field Name | Data Type | Description |

|---|---|---|

| BUKRS | CHAR(4) | Company Code |

| BUKRS_TEXT | CHAR(30) | Company Code Description |

| STRAS | CHAR(30) | Street Address |

| STRAS2 | CHAR(30) | Street Address (2nd line) |

| STRAS3 | CHAR(30) | Street Address (3rd line) |

| STRAS4 | CHAR(30) | Street Address (4th line) |

| ORT01 | CHAR(30) | City |

| PSTLZ | CHAR(10) | Postal Code |

| LAND1 | CHAR(3) | Country |

| WAERS | CHAR(5) | Currency |

| FINREP_REQ | CHAR(1) | Financial Reporting Requirements |

Significance of the SAP Company Code Table

The SAP Company Code table is a vital component of the SAP ERP system, as it enables companies to manage their financial data and reporting requirements efficiently. The Company Code table is used to:

- Identify and differentiate between company codes

- Store and manage company code-related data

- Generate financial reports and statements

- Comply with tax and regulatory requirements

- Integrate with other SAP modules, such as Controlling and Treasury

Best Practices for Managing the SAP Company Code Table

To ensure effective management of the Company Code table, it is essential to follow best practices, including:

- Maintaining accurate and up-to-date company code data

- Ensuring data consistency across all SAP modules

- Regularly reviewing and updating company code descriptions and addresses

- Utilizing SAP standard functionality and reporting tools

- Providing adequate training and support to end-users

Key Points

- The SAP Company Code table is a critical component of the SAP ERP system, storing and managing company code-related data.

- The Company Code table consists of several fields, including company code, description, address, and financial reporting requirements.

- The table is used to identify and differentiate between company codes, store and manage company code-related data, and generate financial reports and statements.

- Best practices for managing the Company Code table include maintaining accurate and up-to-date data, ensuring data consistency, and utilizing SAP standard functionality and reporting tools.

- Effective management of the Company Code table is essential for financial reporting, accounting, and compliance purposes.

In conclusion, the SAP Company Code table is a vital component of the SAP ERP system, playing a critical role in financial reporting, accounting, and compliance. By understanding the structure and content of the Company Code table, and following best practices for its management, companies can ensure accurate and efficient financial data management.

What is the purpose of the SAP Company Code table?

+The SAP Company Code table is used to store and manage company code-related data, including company code descriptions, addresses, and financial reporting requirements.

How is the SAP Company Code table used in financial reporting?

+The SAP Company Code table is used to generate financial reports and statements, such as balance sheets and income statements, for each company code.

What are the best practices for managing the SAP Company Code table?

+Best practices for managing the Company Code table include maintaining accurate and up-to-date data, ensuring data consistency, and utilizing SAP standard functionality and reporting tools.