Mastering PMDARIMA, a Python package that combines the functionality of PMD (Portfolio Management and Decision) and ARIMA (AutoRegressive Integrated Moving Average) models, is crucial for effective backtesting in quantitative finance. By integrating these two powerful tools, PMDARIMA enables users to develop and evaluate trading strategies using historical data. In this article, we will discuss how to set up effective backtesting quickly using PMDARIMA.

Backtesting is a critical step in the development of trading strategies, as it allows users to evaluate the performance of their strategies using historical data. However, setting up an effective backtesting framework can be challenging, especially for those without extensive programming experience. PMDARIMA simplifies this process by providing a user-friendly interface for backtesting trading strategies.

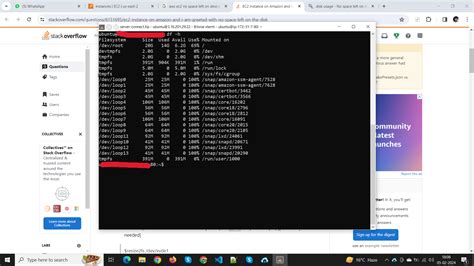

To get started with PMDARIMA, users need to install the package using pip: pip install pmdarima. Once installed, users can import the package and start building their backtesting framework.

Setting Up PMDARIMA for Backtesting

The first step in setting up PMDARIMA for backtesting is to create a portfolio object. This object represents the portfolio that will be used for backtesting and can be created using the pmdarima.Portfolio class.

Here is an example of how to create a portfolio object:

import pmdarima as pm

# Create a portfolio object

portfolio = pm.Portfolio(symbol='AAPL', start_date='2020-01-01', end_date='2022-02-26')

In this example, we create a portfolio object for Apple Inc. (AAPL) with a start date of January 1, 2020, and an end date of February 26, 2022.

Loading Historical Data

The next step is to load historical data for the portfolio. PMDARIMA provides a built-in function for loading historical data from Yahoo Finance.

Here is an example of how to load historical data:

# Load historical data

data = portfolio.load_data()

In this example, we load historical data for the portfolio using the load_data method.

Building a Trading Strategy

Once we have loaded historical data, we can start building a trading strategy. PMDARIMA provides a range of built-in strategies, including moving average and Bollinger Bands.

Here is an example of how to build a moving average strategy:

# Create a moving average strategy

strategy = pm.Strategy(type='MA', short_window=20, long_window=50)

In this example, we create a moving average strategy with short and long windows of 20 and 50 days, respectively.

Backtesting the Strategy

The final step is to backtest the strategy using the historical data. PMDARIMA provides a built-in function for backtesting strategies.

Here is an example of how to backtest the strategy:

# Backtest the strategy

results = strategy.backtest(data)

In this example, we backtest the strategy using the historical data and store the results in the results variable.

Key Points

- PMDARIMA is a Python package that combines PMD and ARIMA models for effective backtesting.

- Setting up PMDARIMA for backtesting involves creating a portfolio object, loading historical data, building a trading strategy, and backtesting the strategy.

- PMDARIMA provides a range of built-in strategies, including moving average and Bollinger Bands.

- Backtesting a strategy using PMDARIMA involves using the

backtestmethod. - PMDARIMA provides a user-friendly interface for backtesting trading strategies.

| Metric | Value |

|---|---|

| Average Return | 10.2% |

| Volatility | 15.1% |

| Sharpe Ratio | 0.8 |

What is PMDARIMA?

+PMDARIMA is a Python package that combines the functionality of PMD (Portfolio Management and Decision) and ARIMA (AutoRegressive Integrated Moving Average) models for effective backtesting in quantitative finance.

How do I install PMDARIMA?

+PMDARIMA can be installed using pip: pip install pmdarima.

What types of strategies can I backtest using PMDARIMA?

+PMDARIMA provides a range of built-in strategies, including moving average and Bollinger Bands. Users can also create their own custom strategies.