Writing a check correctly is a crucial aspect of personal and business finance, ensuring that transactions are processed efficiently and without errors. Although the rise of digital payments has somewhat reduced the frequency of check writing, it remains a vital skill, especially for significant transactions or when dealing with entities that prefer or require checks. The process involves several steps, each critical to the check's validity and acceptance.

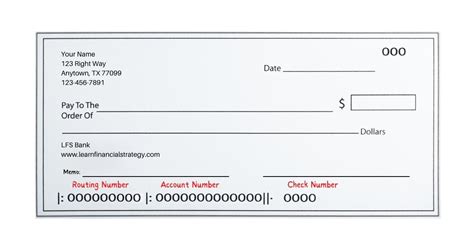

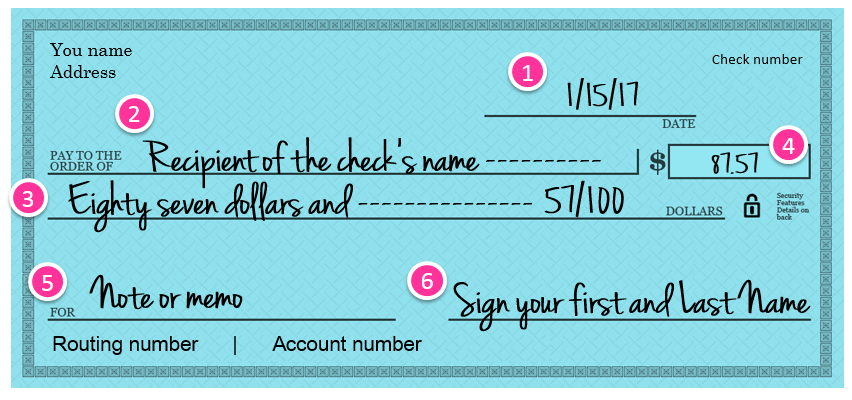

Understanding the Components of a Check

A check is a negotiable instrument that contains several key components, each serving a specific purpose. The date line, typically found at the top right corner, indicates when the check is written. It’s essential to use the current date or a future date if the check is postdated, as checks cannot be dated before the current date. The next critical component is the payee line, where the name of the recipient is written. This should match the name on the recipient’s identification to avoid any potential issues during the deposit process.

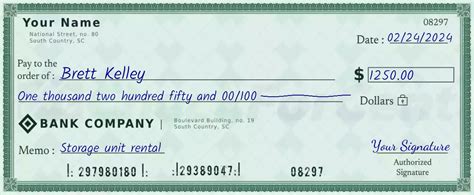

Writing the Dollar Amount

One of the most critical steps in writing a check is filling in the dollar amount. This is done in two places: the numeric amount in the box on the right side and the written amount on the line that precedes the payee line. The numeric amount is straightforward, filling in the dollars and cents with numbers. However, the written amount requires writing out the dollar amount in words. For example, if the check is for $1250, the numeric amount would be “1250.00,” and the written amount would be “One Thousand Two Hundred Fifty Dollars and 00/100 cents.” It’s crucial that both amounts match exactly to avoid any discrepancies that could lead to the check being rejected.

| Component | Description |

|---|---|

| Date Line | Indicates when the check is written |

| Payee Line | Name of the recipient |

| Dollar Amount | Amount of the check in both numeric and written form |

| Signature | Authorization for the check to be cashed or deposited |

| Memo Line |

After filling in the necessary information, the final step is signing the check. The signature line is usually found at the bottom right corner and serves as the authorization for the check to be cashed or deposited. It's essential that the signature matches the one on file with the bank to prevent any issues with verification.

Best Practices for Writing Checks

Beyond the technical aspects of filling out a check, there are several best practices to keep in mind. Using a pen, preferably black or blue ink, can help prevent alterations. It’s also advisable to keep a record of the check number, date, payee, and amount in your check register. This helps in balancing your account and keeping track of your expenses. Regularly reviewing your account statements can help detect any discrepancies or fraudulent activities.

Key Points for Writing a Check Correctly

- Use the current date or a future date for postdated checks.

- Ensure the payee's name matches their identification.

- Fill in the dollar amount correctly in both numeric and written forms, ensuring they match.

- Sign the check with a signature that matches the one on file with your bank.

- Keep a record of the check in your check register for accounting and tracking purposes.

In conclusion, writing a check correctly involves attention to detail and adherence to best practices. By understanding the components of a check, filling in the information accurately, and following the guidelines for signature and record-keeping, individuals can ensure that their transactions are processed smoothly and securely.

What is the importance of matching the written and numeric amounts on a check?

+Matching the written and numeric amounts is crucial because any discrepancy could lead to the check being rejected. Banks verify that both amounts are the same to prevent fraud and ensure the check’s legitimacy.

Why is it recommended to use a pen when writing a check?

+Using a pen, especially with black or blue ink, helps prevent alterations. Pencil marks can be easily erased and changed, which could lead to fraudulent activities. Ink is more permanent, providing an added layer of security.

What should I do if I make a mistake while writing a check?

+If you make a mistake, it’s best to void the check and start over. Write “VOID” across the check in large letters to prevent it from being used. Then, fill out a new check with the correct information. This ensures that the transaction is accurate and avoids any potential issues.