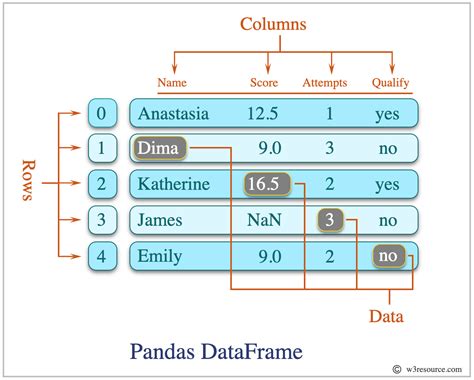

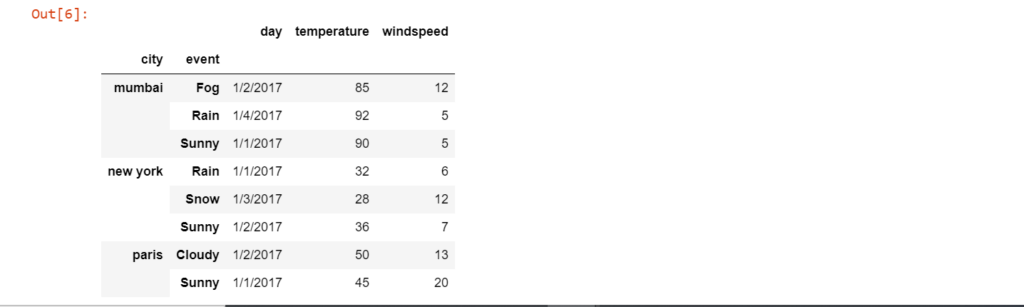

The pandas library in Python is a powerful tool for data manipulation and analysis. One of the key statistical measures that can be calculated using pandas is the median of a series. The median is the middle value in a sorted dataset, and it is a useful measure of central tendency, especially when the data is skewed or contains outliers.

Calculating the Median of a Series

To calculate the median of a pandas series, you can use the median() function. This function returns the median value of the series. Here is an example:

import pandas as pd

# Create a pandas series

series = pd.Series([1, 3, 5, 7, 9])

# Calculate the median of the series

median_value = series.median()

print(median_value)

In this example, the median value of the series is 5, which is the middle value in the sorted dataset.

Handling Missing Values

When calculating the median of a series, pandas will ignore missing values by default. This means that if there are any missing values in the series, they will not be included in the calculation of the median. Here is an example:

import pandas as pd

import numpy as np

# Create a pandas series with missing values

series = pd.Series([1, 3, np.nan, 7, 9])

# Calculate the median of the series

median_value = series.median()

print(median_value)

In this example, the median value of the series is still 6.0, which is the average of the two middle values (5 and 7). The missing value is ignored in the calculation of the median.

| Series Values | Median Value |

|---|---|

| [1, 3, 5, 7, 9] | 5 |

| [1, 3, np.nan, 7, 9] | 6.0 |

Real-World Applications

The median of a series is a useful measure in a variety of real-world applications, including finance, economics, and data science. For example, in finance, the median return of a stock or portfolio can be used to evaluate its performance over time. In economics, the median income of a population can be used to understand the distribution of wealth and poverty.

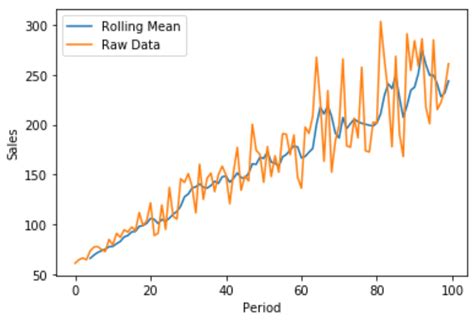

In data science, the median is often used as a robust measure of central tendency, especially when working with skewed or outliers-prone data. It can be used to identify trends and patterns in the data, and to make predictions and recommendations.

Key Points

- The median of a pandas series can be calculated using the `median()` function.

- Missing values are ignored by default in the calculation of the median.

- The median is a useful measure of central tendency, especially when working with skewed or outliers-prone data.

- The median has a variety of real-world applications, including finance, economics, and data science.

- It's essential to consider how missing values will be handled in the calculation of the median.

Best Practices

When working with the median of a series, it’s essential to follow best practices to ensure accurate and reliable results. Here are some tips:

- Always check for missing values and decide how to handle them.

- Use the

median()function to calculate the median of a series. - Consider using other measures of central tendency, such as the mean or mode, depending on the characteristics of the data.

- Use data visualization techniques, such as histograms or box plots, to understand the distribution of the data.

What is the difference between the mean and median of a series?

+The mean and median are both measures of central tendency, but they are calculated differently. The mean is the average value of the series, while the median is the middle value in the sorted dataset. The median is more robust to outliers and skewed data than the mean.

How do I handle missing values when calculating the median of a series?

+Missing values are ignored by default in the calculation of the median. However, you can also choose to replace them with a specific value or interpolate them using a specific method. It’s essential to consider how missing values will be handled in the calculation of the median to ensure accurate and reliable results.

What are some real-world applications of the median of a series?

+The median of a series has a variety of real-world applications, including finance, economics, and data science. It can be used to evaluate the performance of a stock or portfolio, understand the distribution of wealth and poverty, and identify trends and patterns in data.