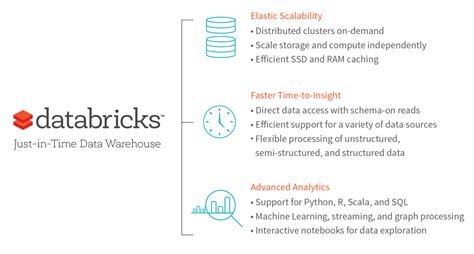

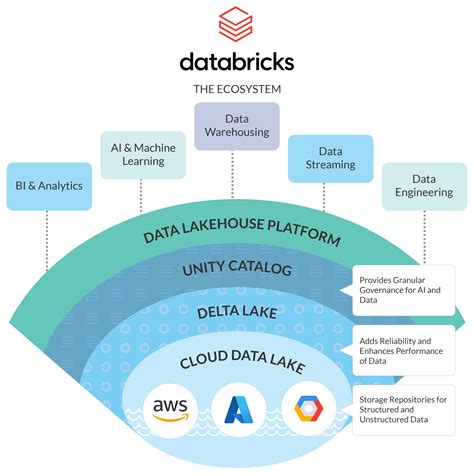

As the world of big data and analytics continues to evolve, companies like Databricks are at the forefront of innovation, providing cutting-edge solutions for data processing, analytics, and artificial intelligence (AI). Founded by the original creators of Apache Spark, Databricks offers a cloud-based platform that allows businesses to manage and analyze large-scale data sets, driving insights and decision-making. For investors looking to capitalize on the growth of the big data and analytics market, here are 5 ways to invest in Databricks:

Key Points

- Investing in Databricks through venture capital firms or private equity investments

- Participating in initial public offerings (IPOs) or direct listings

- Purchasing shares of publicly traded companies that have invested in or partnered with Databricks

- Investing in exchange-traded funds (ETFs) or mutual funds with exposure to the big data and analytics sector

- Considering alternative investment options, such as crowdfunding or private investment platforms

Investing in Databricks through Venture Capital Firms or Private Equity Investments

One way to invest in Databricks is through venture capital firms or private equity investments. Companies like Andreessen Horowitz, New Enterprise Associates (NEA), and Battery Ventures have invested in Databricks, providing funding for the company’s growth and development. Investors can consider investing in these firms or other venture capital companies that have a track record of investing in successful big data and analytics startups.

Participating in Initial Public Offerings (IPOs) or Direct Listings

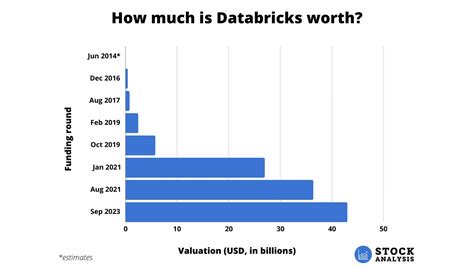

Another way to invest in Databricks is by participating in an initial public offering (IPO) or direct listing. Although Databricks has not yet gone public, the company has raised significant funding through private investment rounds, and an IPO or direct listing is likely in the future. Investors can keep an eye on the company’s progress and consider investing in the IPO or direct listing when it becomes available.

| Investment Round | Amount | Investors |

|---|---|---|

| Series G | $400 million | Andreessen Horowitz, New Enterprise Associates (NEA), Battery Ventures |

| Series F | $250 million | Andreessen Horowitz, New Enterprise Associates (NEA), Battery Ventures |

| Series E | $150 million | Andreessen Horowitz, New Enterprise Associates (NEA), Battery Ventures |

Purchasing Shares of Publicly Traded Companies that Have Invested in or Partnered with Databricks

Investors can also consider purchasing shares of publicly traded companies that have invested in or partnered with Databricks. For example, companies like Microsoft, Amazon, and Google have partnered with Databricks to provide integrated solutions for data analytics and AI. By investing in these companies, investors can gain exposure to the growth of the big data and analytics market and potentially benefit from Databricks’ success.

Investing in Exchange-Traded Funds (ETFs) or Mutual Funds with Exposure to the Big Data and Analytics Sector

Another option for investors is to invest in exchange-traded funds (ETFs) or mutual funds that have exposure to the big data and analytics sector. These funds typically invest in a diversified portfolio of companies that are involved in the development and implementation of big data and analytics solutions. By investing in these funds, investors can gain broad exposure to the sector and potentially benefit from the growth of companies like Databricks.

What are the risks of investing in Databricks?

+Investing in Databricks, like any other private company, carries risks such as the potential for financial losses, regulatory challenges, and market competition. Investors should carefully evaluate these risks before making an investment decision.

How can I invest in Databricks if I'm not an accredited investor?

+While Databricks is a private company and investing in it may be limited to accredited investors, there are alternative investment options available, such as crowdfunding or private investment platforms. However, these options may carry higher risks, and investors should carefully evaluate the terms and conditions before investing.

In conclusion, investing in Databricks requires a deep understanding of the company’s financials, market trends, and competitive landscape. Investors should carefully evaluate the risks and opportunities before making an investment decision. By considering the 5 ways to invest in Databricks outlined above, investors can potentially benefit from the growth of the big data and analytics market and the success of this innovative company.